BIA - Firm Overview

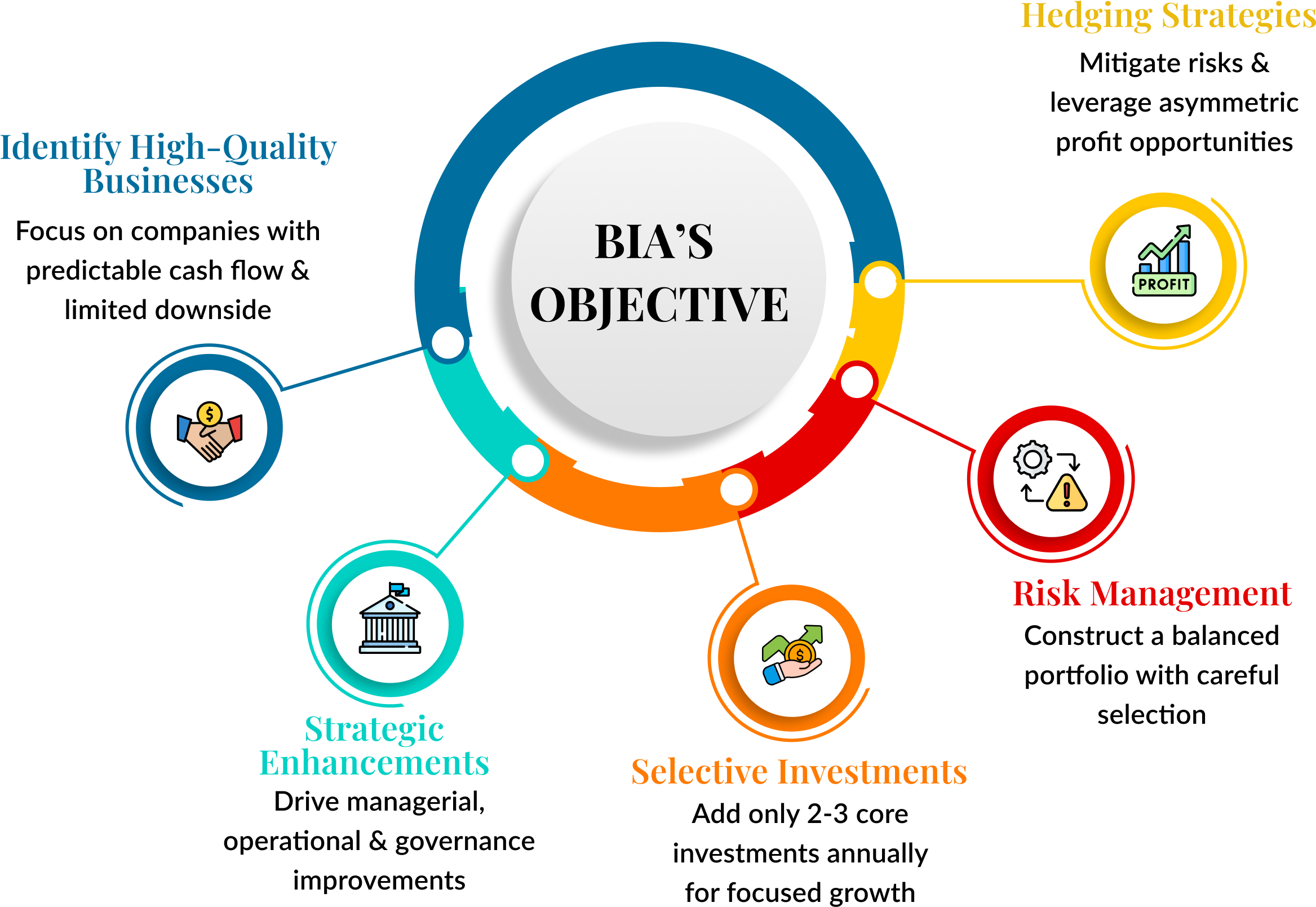

The objective of BIA Investment Advisors is to maximize intrinsic value per share through its long-term compound annual rate of growth. The substantial majority of the Company’s portfolio is typically allocated to 15 to 20 core holdings usually comprising liquid, listed large to mid capitalisation Indian companies.

SEBI registered investment advisor firm

Founded by qualified chartered accountants

Collective experience of more than 40 years in wealth management

Objective & Investment Approach

BIA Edge

Focused Expertise

Our team brings deep industry knowledge and a sharp analytical approach to portfolio construction.

Value-Driven Approach

At the core of our strategy is sustainable value creation through well-researched investments.

Process-Driven Strategy

A structured and differentiated approach to analysis ensures informed decision-making.

Diversified & Resilient

We invest in well-diversified businesses with strong fundamentals for long-term growth.

High Growth Visibility

Our portfolios are designed for consistent growth with solid margin potential.

BIA Strategy

-

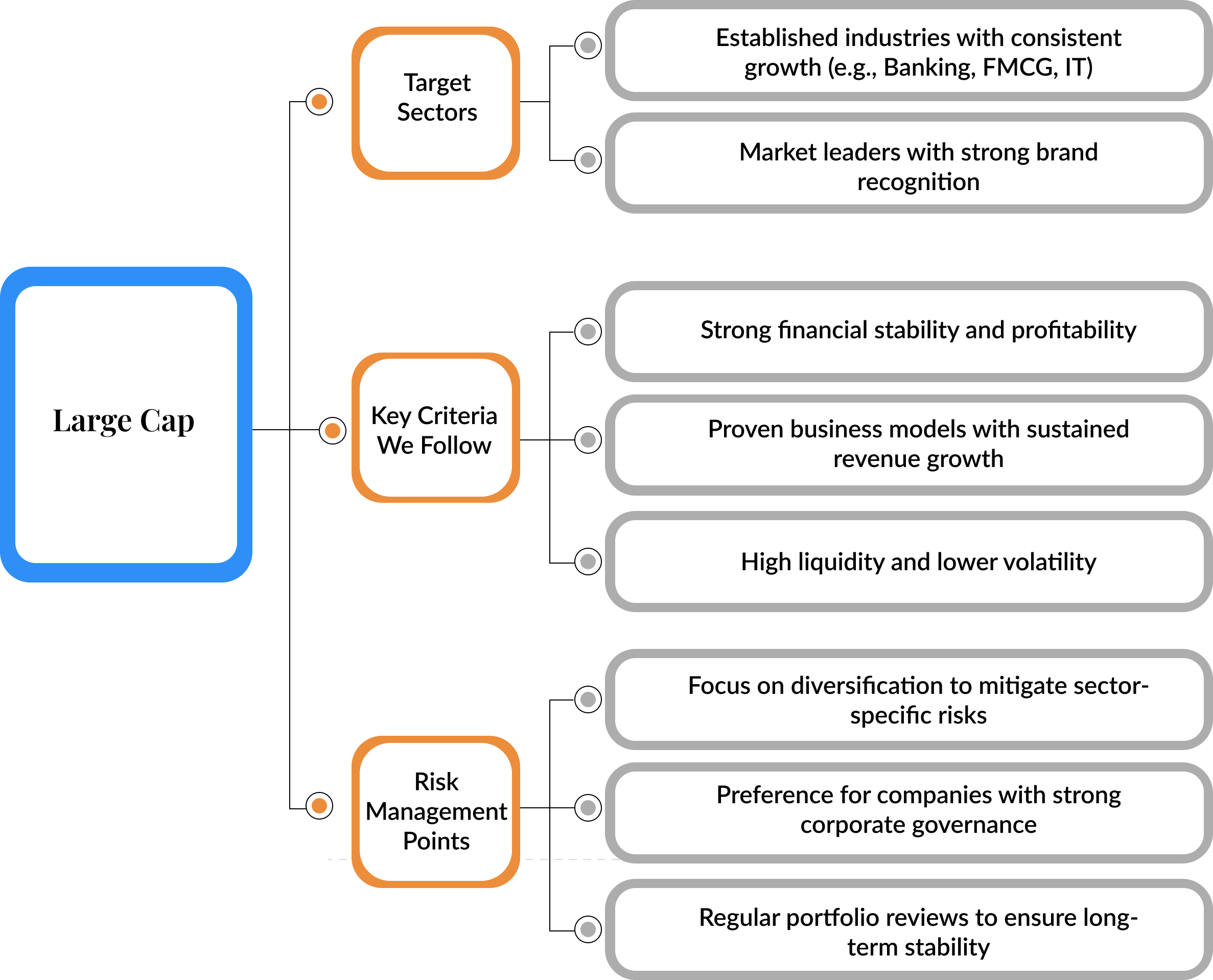

Large Cap

-

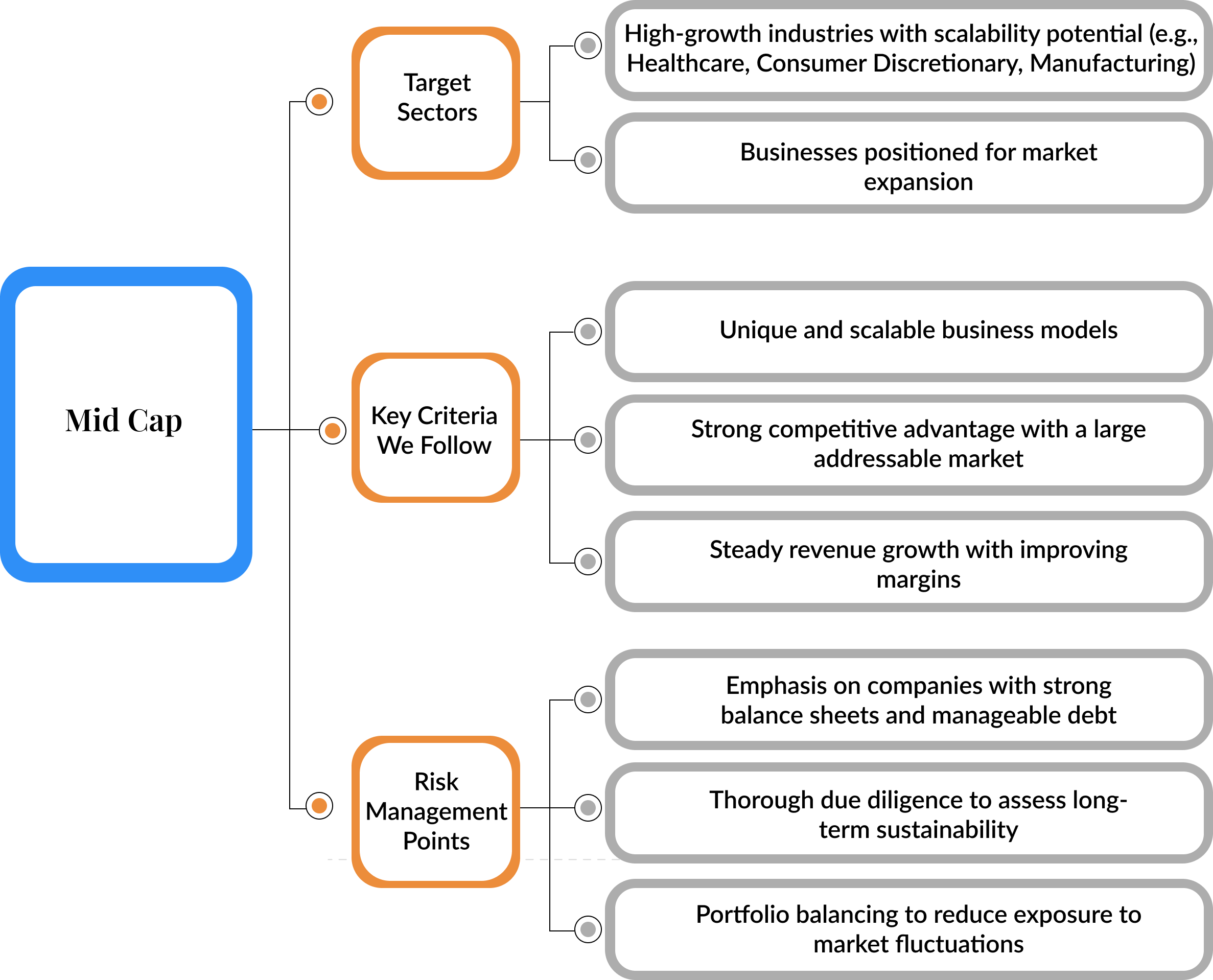

Mid Cap

-

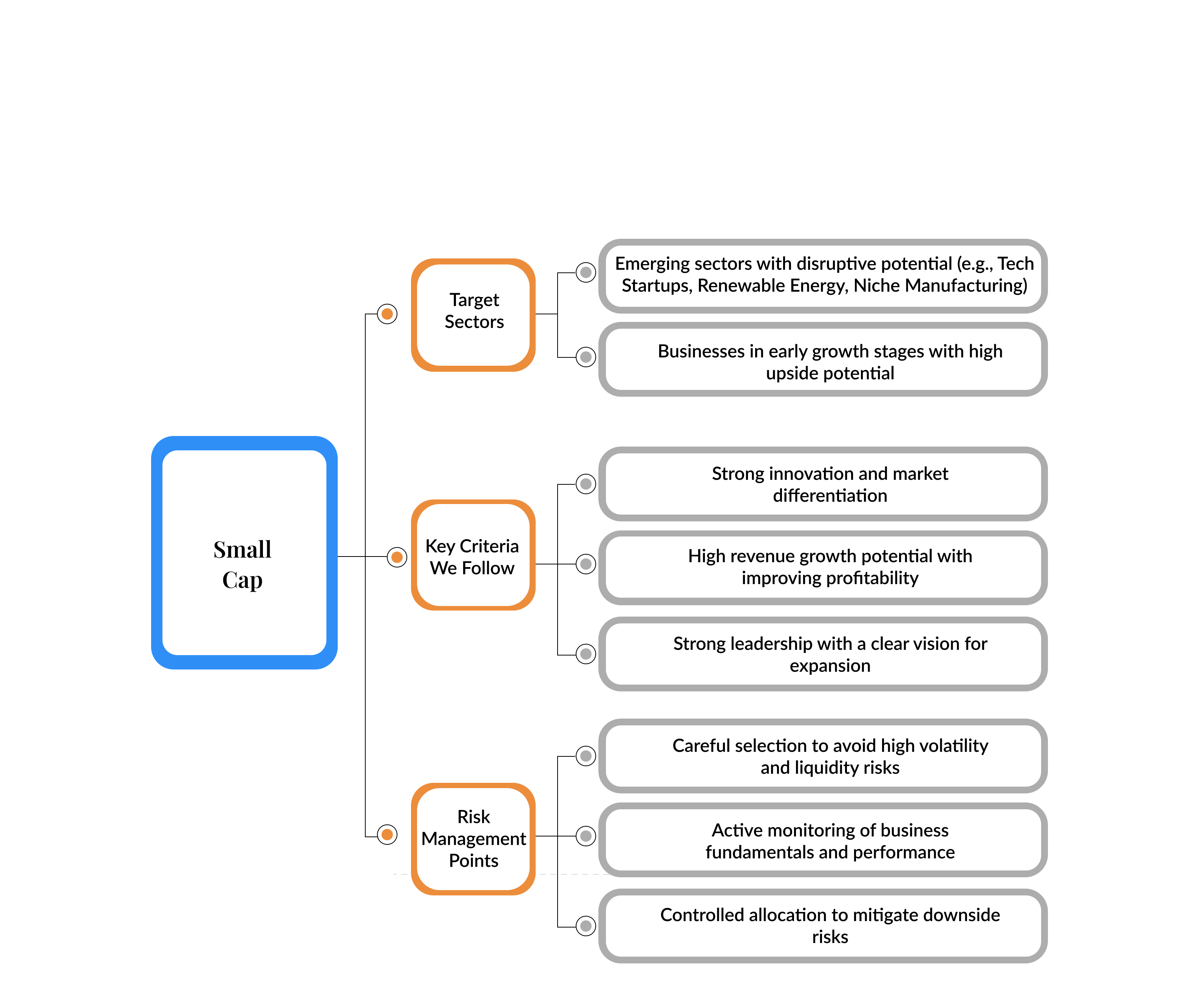

Small Cap

Successful track record

Number of Stocks in portfolio

15 to 25

I’ve been investing for years, but this portfolio strategy has truly transformed my returns. The careful selection of stocks and risk management is impressive!

Rohan Mehta

Rating

Trustworthy, transparent, and results-driven. This portfolio has exceeded my expectations

Ankit Kumar

Rating

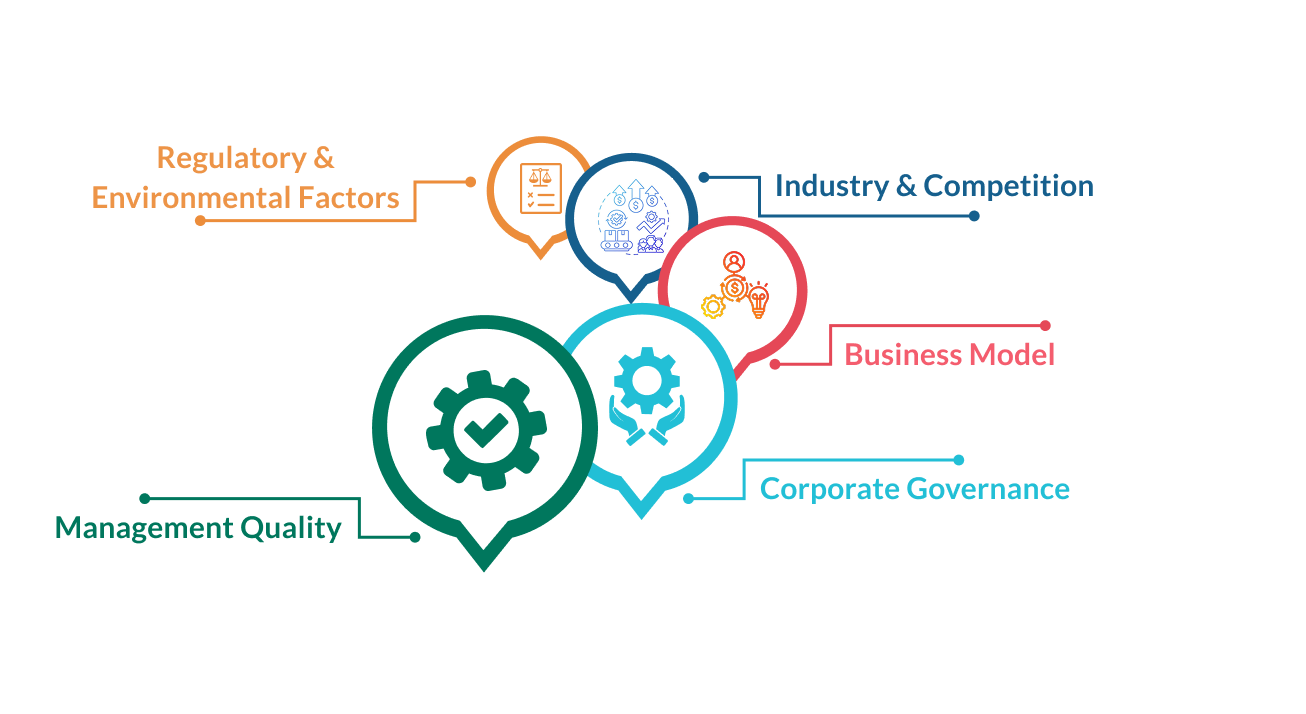

What are the qualititive factors in fundamental analysis?

Investment Framework

Investment Framework – Quality

As Quality of the business is one of most critical factor directly impacting to strength of the business model and longevity of business cycle, it commands the premium assigned to the business.

Business

- Resilient & Profit making

- Competitive advantage

- Scalable

- Free Cash flow

Management

- Equity stake

- Honest & visionary

- Passionate

- Proven track record

Governance

- Board Composition

- Regulatory compliance

- Accountability & Transparency

Investment Framework – Growth

Higher growth in sales and margins leads to higher multiples assigned to the business.

- Superior Growth

- Organic opportunity

- High visibility

- Competitive advantage

- Strong Execution

- Incremental efficiency

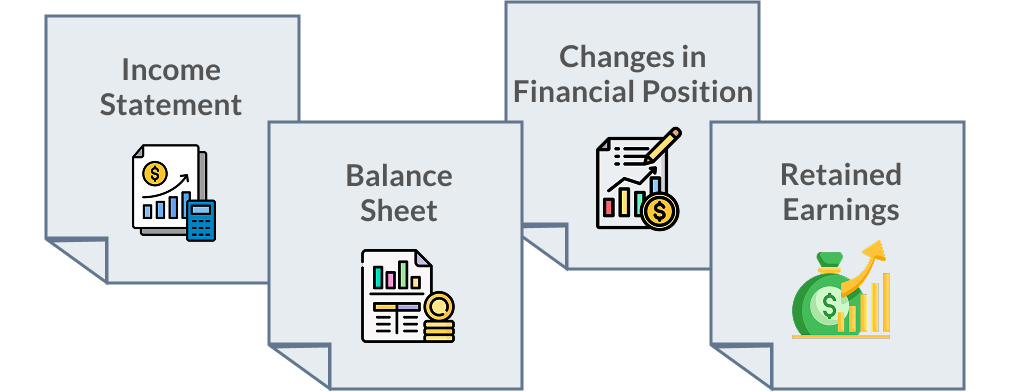

Investment Framework – Forensic Diligence

Real Growth

Growth in terms of Volume excluding intercompany transactions; Policies as to absorption of intangibles and capitalisation of expenses

Financial Efficiency

Operational efficiency: Increased margins and lower volatility

Capital efficiency: In terms of higher incremental ROI and ROCE

Capital Structure

Plough back of capital resulting into strong risk management and reduced cost of equity and capital, thereby increase in ROI.

Working capital

Proper use and management of operational capital resulting into higher asset churn.

Cash flow analysis

Profits are an opinion based on accounting standards and policies, cash is a fact and hence conversion of profit into cash is critical.

Incremental ROI considering the cash deployed in the business.

Investment Framework – Valuation

Current price at a significant discount to intrinsic value

Market assigns higher premium to a quality business and strong financials of the company due to expected outsized returns over the period of time.

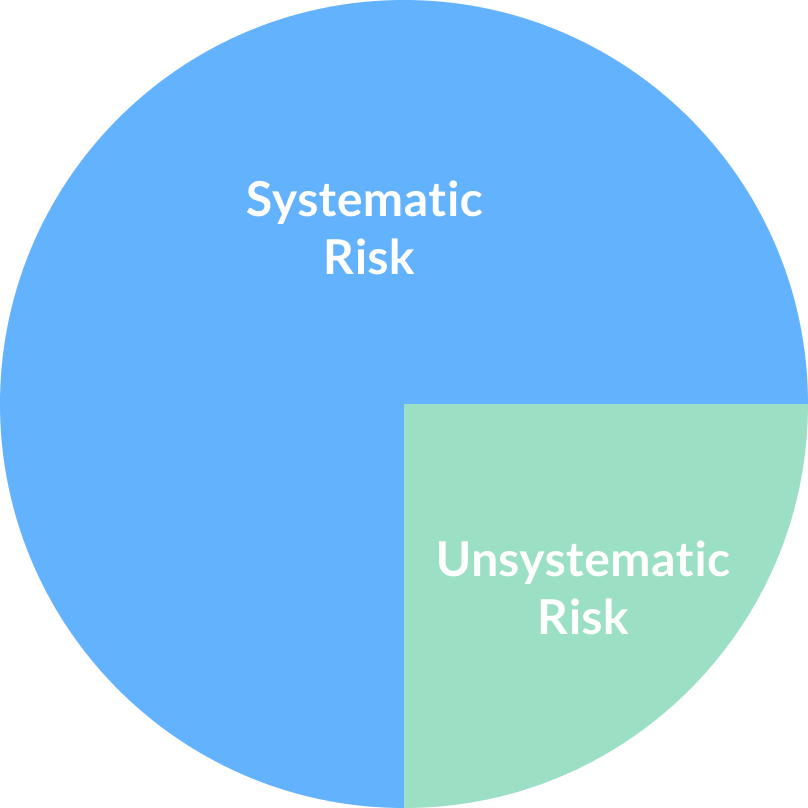

RISK

The risk management is a most critical aspects of portfolio construction. Broadly there are 2 types of risks.

Systemic Risk refers to the risk that affects an entire market, industry, or economy. It is caused by broad external factors like economic recessions, financial crises, or natural disasters and cannot be eliminated through diversification.

Unsystematic Risk (or specific risk) is the risk associated with a particular company or industry. It arises from factors like poor management, regulatory changes, or supply chain disruptions. Unlike systemic risk, it can be minimized through diversification in a well-balanced investment portfolio.

Why Invest in India?

Booming Consumption

Rising middle class and increasing disposable income are driving demand across sectors.

Massive Investments & Exports

India is attracting global capital and expanding its export footprint in multiple industries.

Strategic Geopolitical Shift (China +1)

Global companies are diversifying beyond China, making India a preferred alternative.

Manufacturing Powerhouse

Government initiatives and skilled labor are fueling India’s rise as a global manufacturing hub.

Digital & Tech Innovation

India is a leader in IT, fintech, and startups, shaping the future of digital economies.

Why now?

Capex Revival

Supportive macroeconomic environment fuels rising capital expenditure.

India’s Labour Advantage

India emerges as the largest pool of

cost-effective skilled labour.

High-Value Manufacturing Boom

India’s strong service economy supports the rise of advanced manufacturing, driving economic growth in Amrit Kaal.

Atmanirbhar Bharat Reforms

Government launches self-reliance push with incentives & policy reforms.

Capacity Utilisation Peaks

Industries witness high capacity utilisation with low leverage.

Global Supply Chain Shift (China+1)

Global realignment accelerates, boosting India’s manufacturing sector.

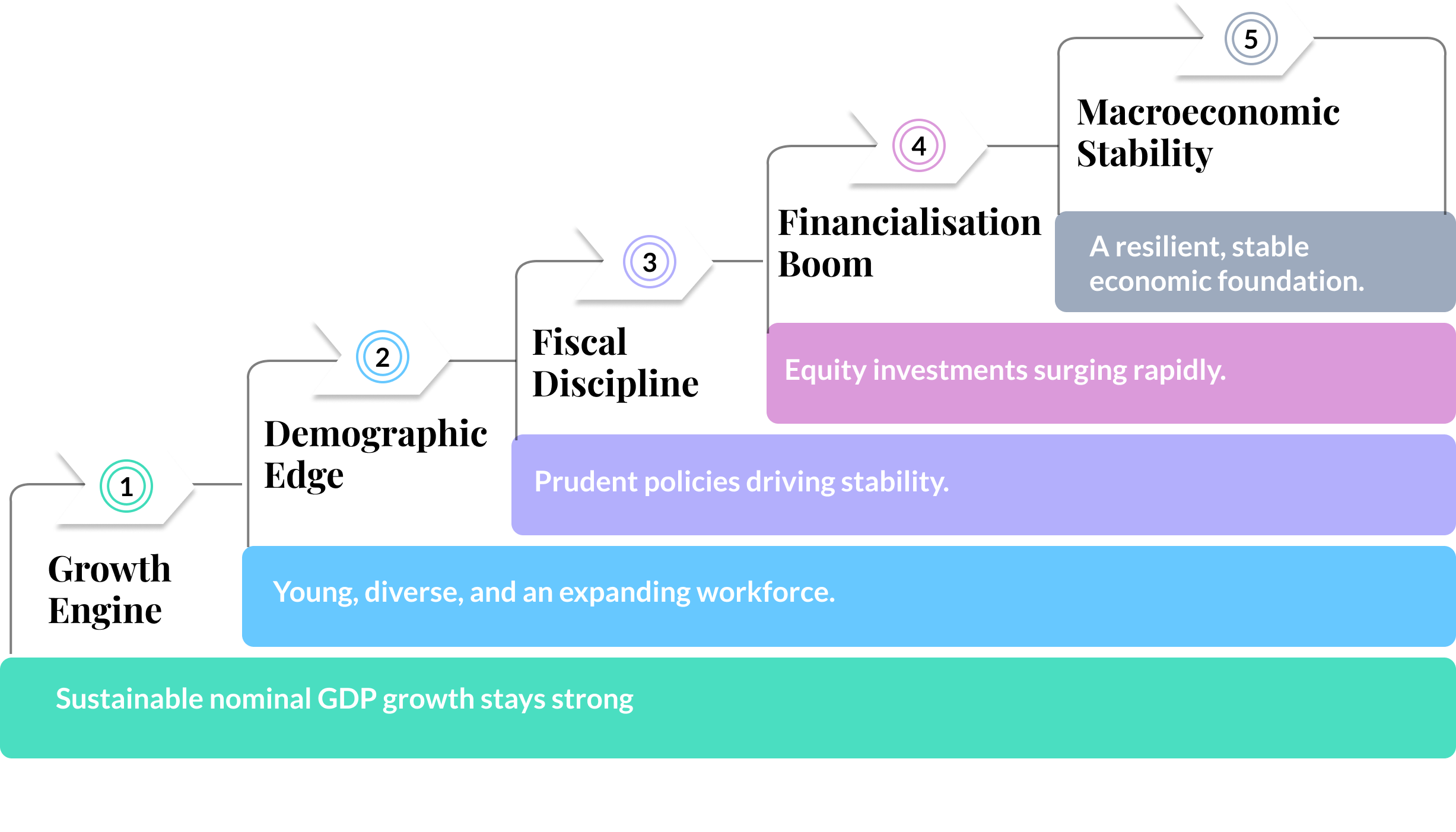

INDIA- GOING FORWARD

India 2025 – Investment Outlook

GDP Forecast

7%+ Growth

Equity Penetration

Rising investor participation

Economic Resilience

Strong global positioning